THE STOCK MARKET, THE JOB MARKET, AND THE SPECTRE OF RECESSION

Are we forever haunted by a bad economy?

Uttered during his inauguration speech and repeated when addressing Congress a month later, President Trump believes that his tariffs policy, deregulation, and burgeoning alliance with major players in Silicon Valley will usher in a “Golden Age” for the US economy. However, within a week of addressing Congress, the stock market—which hit record highs after his election in November—saw a near-900-point dive in the Dow on Monday, March 10, and the Nasdaq had its worst day since 2022.

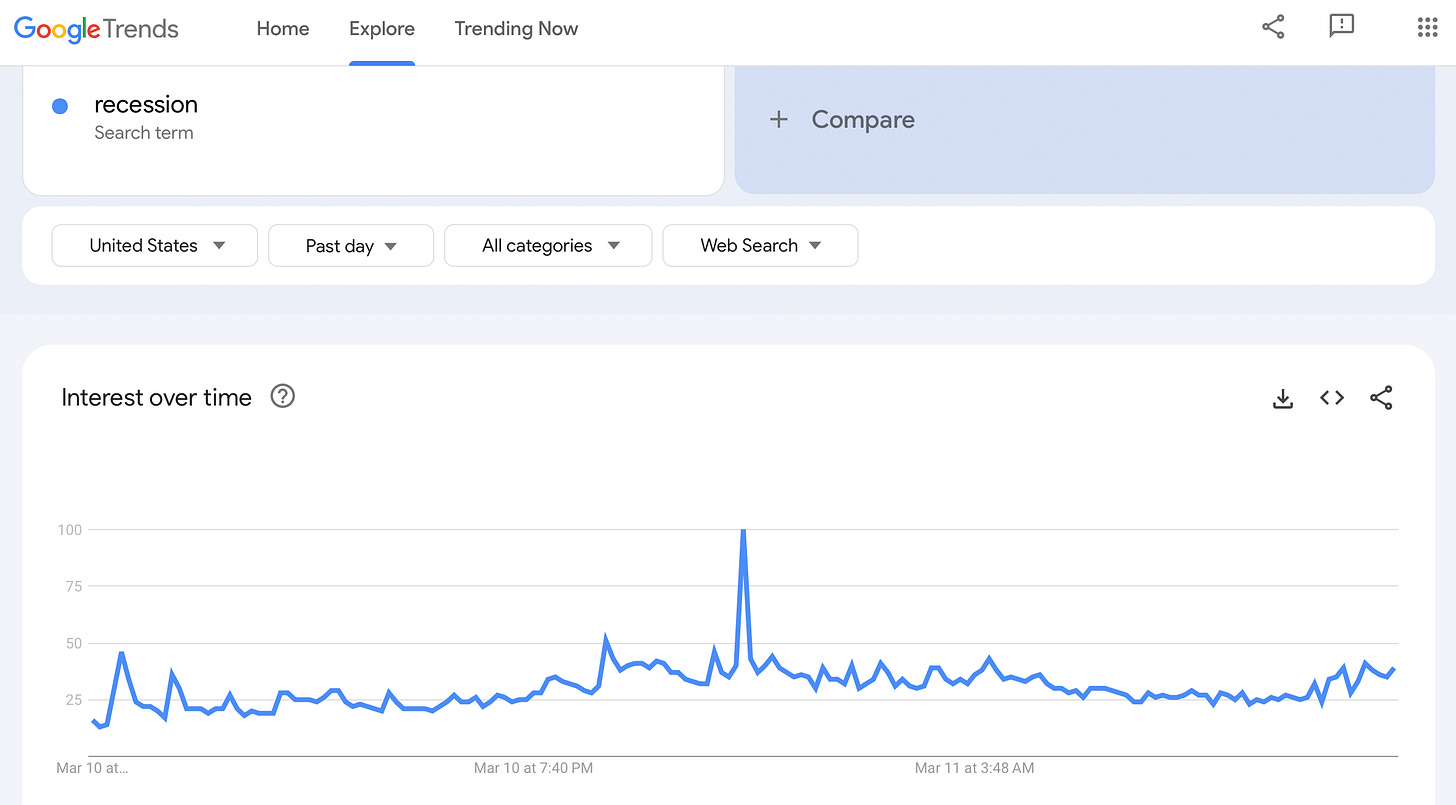

This steep drop in stocks prompted speculation among news outlets of an impending recession. Interest in the term skyrocketed as the Monday sell-off was underway.

To understand if the US is headed toward a recession, it’s best to understand the term. The word is often used, but what qualifies as a recession?

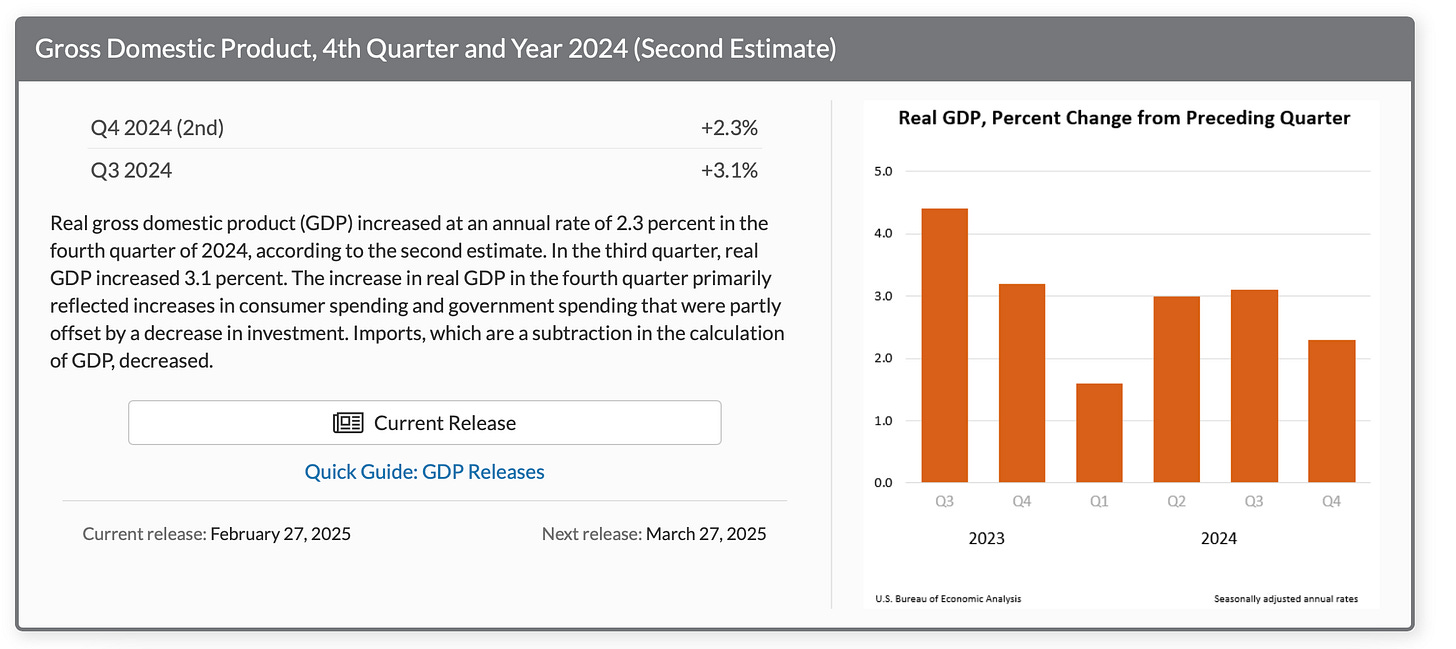

A recession is defined as “two consecutive quarters of negative growth.” This growth is usually measured by GDP. Since the economy grew by 2.3% during Q4 2024, we won’t know the extent of a possible contraction until the end of March 2025. This contraction would have to continue for another three months for the US to be in a recession.

Although this is the definition of a recession, is there a better way to define it? The sentiment during President Biden’s term in office was that while the US may not have been in a recession on paper, rising prices due to inflation and a stagnant job market made the electorate feel the opposite of what the economists and analysts were saying.

In a strange way, the people and the experts were both right.

The US economy is growing, but this does not negate the effect of inflation on the average consumer, or the contraction in some parts of the economy while other parts expand.

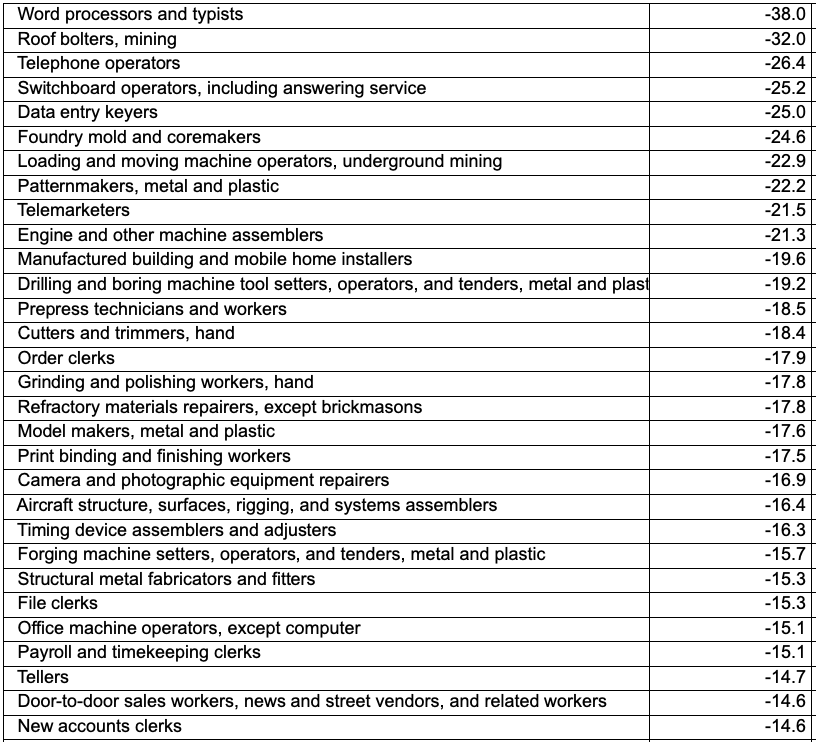

For example, below is a list of the ten fastest-declining occupations in the US. The numbers represent the percentage of jobs lost between 2022 and 2023.

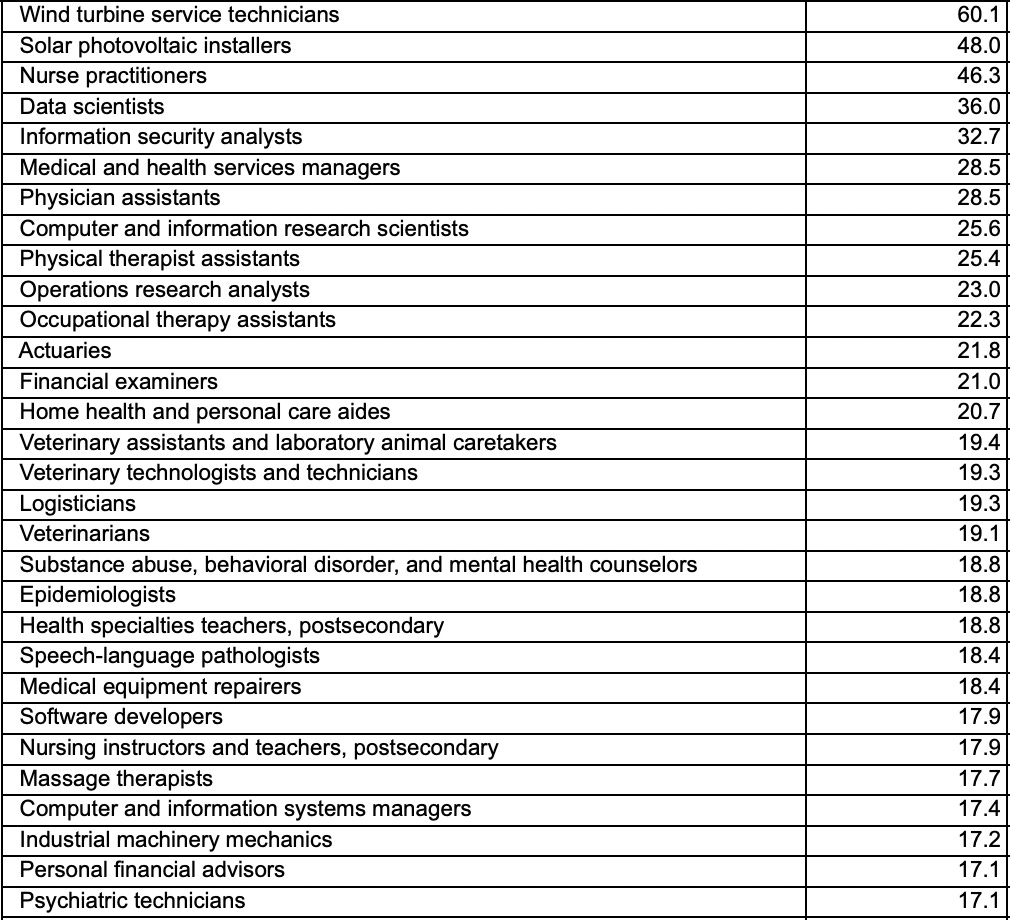

Now take a look at the 30 fastest-growing occupations and their percentage increases over the same period.

If you are unfortunately in a declining occupation, you are living in a recession. If you are in an expanding occupation, the economy is doing well. To take it a step further, if you are in a region whose economy has long depended on one of the declining occupations, you and your environment are in a full economic downturn. If you are in a region adding several expanding occupations at once, you are in an economic boom. But, to be clear, this does not consider the cost of living and taxes in the respective regions where these jobs are hiring and firing.

As economies evolve, there will be “winners and losers.” I examined this in the master’s thesis on the effect of NAFTA on auto parts manufacturing jobs in the US. While the US saw overall gains after NAFTA was signed, my hometown of Flint, Michigan was left in ruins. This was partly due to NAFTA, but advances in technology and transportation had already conspired to shutter most factories. The economy will have highs and lows and will shift accordingly. To repeat a quote from Warren Buffett, “For 240 years, it’s been a terrible mistake to bet against America.” So, don’t count the US out, and, to modify a quote from economist Thomas Sowell, modern workers must equip “themselves “with skills that others are willing to pay for.”

Thought you may find this interesting.

https://torrancestephensphd.substack.com/p/to-tariff-or-not-to-tariff-that-is